Allen Campbell, Risk All-Stars

McAlan LC

What is your educational background?

BA College of Wooster, JD Columbia University Law School, MBA University of Chicago

Did you know you wanted to go into the risk profession? If not, what was your journey to get here?

No. I started off as a lawyer. Of course, the essence of that work is to protect your clients against bad outcomes, so I suppose I was “managing risk” even back then. I got an MBA at the University of Chicago, with a concentration in finance. I studied under three Nobel laureates and became highly educated in investment risk. I later became an investment banker with Bear Stearns in NYC. That is when I was first introduced to risk management as a professional discipline. Pittston’s executive recruitment firm contacted me; they wanted a person like me to become their director of risk management and then get promoted to CFO. Instead, I went to Arthur D. Little in Cambridge, MA as a consultant to the CEO and the head of ADL Enterprises to help the firm develop business strategy.

In due course, I became an entrepreneur, which of course involves managing opportunities and risks of all kinds. For my history see www.linkedin.com/in/allencampbelljdmba. A few years ago, I became a close friend with Peter Christman, the founder of the Exit Planning Institute, and his Australian friend, Peter Hickey, the founder of the Institute of Advisors, both of whom urged me to go into the exit-planning advisory field. I have come to know a lot about that field — de-risking the enterprise is central to exit planning — but I chose not to enter that profession. Along came 2020 and COVID-19. In in the spring of 2020, Peter Hickey asked me to edit his workbook, Survive and Thrive in a Crisis, and I came to believe that risk and crisis management would be suitable field for my background, talents, and personality. It “calls to me,” for many reasons, including the idea of comprehensively dealing with all kinds of risks. See my website, www.McAlan.com.

How long have you been working in the risk profession?

I’ve been managing risks and crises since the inception of my professional life – but only in the last two years have I been involved explicitly with risk and crisis management. McAlan has just been launched.

Has managing risk changed over the course of your career? If so, how?

Yes. When I first started practicing law, if you had asked me what is risk management, I probably would have thought of it narrowly, wearing my big-firm lawyer’s hat, allocating risks in contracts, dealing with compliance or litigation risks, or as something that insurance brokers/companies and/or actuaries dealt with. I now see risk management very broadly, transcending the boundaries of silos, with more professionalism, for the client’s overall well-being, and not just selling insurance. I think your firm is doing a great job of bringing leadership to today’s risk management.

What advice would you give to someone who is about to start their career in the risk profession?

Get the best relevant education, start working for the best firm you can, maybe ask for a job, or at least solicit advice.

Do you have a personal motto? If so, what is it?

It’s not really my personal motto. It is my company’s motto: “Better Outcomes with Better Advice.”

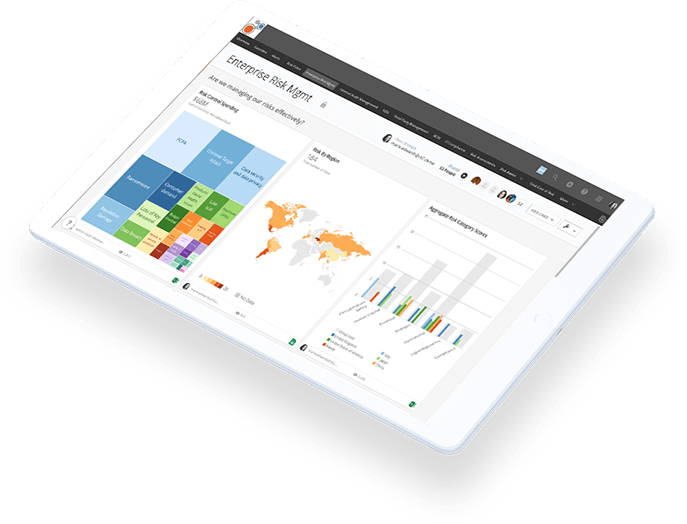

How’s Your View?

Find out how

Riskonnect can transform

the way you view risk.