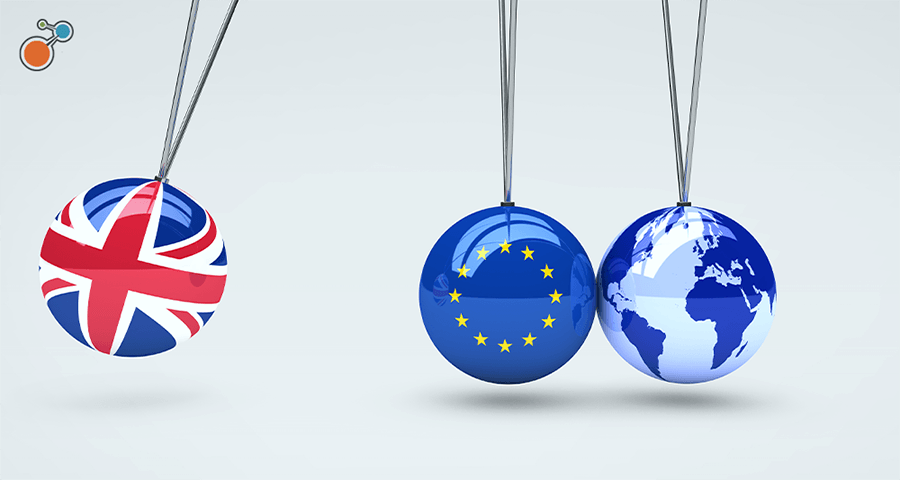

EU law ceased to apply in the UK on January 1, 2020, under a last-minute trade deal between the UK and the EU. The question now is what impact will Brexit have on the UK financial services industry?

The financial services industry has spent years assessing Brexit’s potential impact on the business, and while a signed agreement is a relief over a no-deal Brexit, the finer details remain uncertain. This is extremely disconcerting for those whose future success depends on continued cooperation with the EU.

Here are three areas in the current Brexit legislation of particular concern to the financial services industry:

Equivalence

Equivalence refers to a decision by one European country to recognise another country’s legal requirements for regulating a good or service, even if the requirements differ slightly.

In practice, this means that a financial services company can operate in or trade with two countries, as long as the company complies with the regulatory requirements of one of those countries. It is still unclear, however, if this decision will become permanent or to what extent the UK will have access to the EU market long term.

The EU has signalled a willingness to agree to equivalence in some areas, but the absence of a full-equivalence agreement is unsettling for financial institution operating internationally.

There is hope. As a previous member of the single market, the UK might be granted equivalence in areas beyond those currently provided in the EU. This would require new EU legislation to update the current equivalence frameworks, which the EU is considering.

Passporting

The UK’s right to do business in any other European Economic Area (EEA) without authorization ended on December 31, 2020. Consequently, UK financial institutions must cease trading with other EU member states or seek separate authorization to operate in individual states – a complex and costly process.

Equivalence decisions may shape how financial institutions are able to trade with the EU member states moving forward. These decisions could, for instance, impact how easily firms can apply for licences to operate in EU member states and how easily UK financial institutions can access European consumers.

The UK has implemented a Temporary Permissions Regime to support EEA-based firms operating in the UK with a passport. However, an equivalent EU-wide scheme for UK firms operating in the EU does not currently exist. Some member states, such as Ireland and Denmark, established temporary permissions effective January 1, 2021, to support UK firms working in particular financial markets.

Job Migration

Since the Brexit referendum of 2016, more than 7,500 financial services jobs and £1 trillion in assets have migrated from the UK to European cities. In September 2020 alone, more than 400 positions were relocated, and there is concern that this trend will continue.

A commitment to regulatory cooperation between both sides may be enough to deter financial institutions from making rash decisions. For some, however, the current uncertainty is making it difficult to assure UK-based roles.

It seems likely firms will continue to consider moving operations away from London to places where they can serve a wide customer base. Paris, Frankfurt, Amsterdam, and Dublin have been the main beneficiaries so far of jobs and assets moving out of London.

Even with a signed trade deal in place, many unanswered questions remain about the real impact of Brexit on the UK financial services industry.

Also worthy of mention is the fact that there is no agreement on short-term business visits or on recognition of qualifications. While the immediate impact of this is minimal because of COVID-19 restrictions, this has the potential to cause significant disruption in terms of working on cross-border projects or servicing customers.

Further talks between the UK and Brussels are expected over the coming months, which will hopefully bring some answers. Until equivalence decisions are firmly in place, however, the prospect of regulatory divergence between the UK and EU is very real.

For more on issues affecting UK financial services, check out The Top 5 Risk Management Challenges Facing UK Financial Services in 2021.